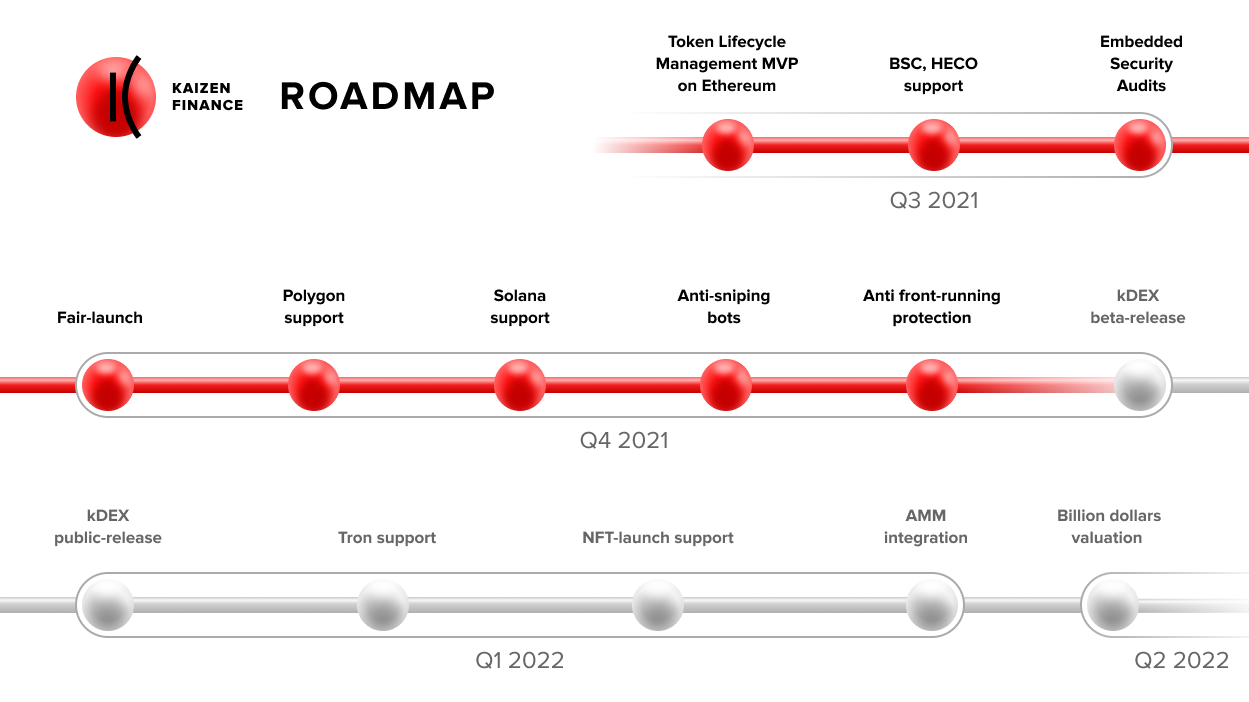

About Kaizen Finance

Project Name: Kaizen Finance

IDO Date: 01/12/2021

About

Kaizen Finance is a no-code cross-chain token lifecycle management platform where projects can securely and reliably generate, issue, and manage tokens, vesting schedules, token sale and staking. As it’s usual for the industry, tokens created via the Kaizen platform can be locked i.e. set aside by a smart contract for a specified period of time. What’s brand new about Kaizen, the issuer can use locked tokens as collateral and issue tradable collateralized tokens, which represent an ownership claim on an underlying asset locked in the Kaizen smart contract. Collateralized tokens reflect the value of locked tokens before unlock. When locked tokens become available for the unlock per vesting schedule, collateralized tokens are used to be exchanged to unlocked tokens on Kaizen Finance. Collateralized tokens can be distributed to investor wallets immediately after the purchase of locked tokens, and it creates a user experience, totally different from traditional industry standards. Moreover, collateralized tokens can be traded on the decentralized exchange, called kDEX, designed by Kaizen Finance to unlock a $200 bln market of locked liquidity trading.

Our Team

Evgen Verzun

Founder

David Lim

COO-FounderSocial Channels

Product Features

The project creates the range of values:

- Support all life cycle phases of a token offering (from token-generation and presales to the TGE and the following listings);

- Execute cross-chain transactions (moving tokens from one blockchain to another to save on gas fees or to engage in DeFi offerings unique to a specific blockchain);

- Set vesting schedules and clearly embed terms into locked tokens;

- Automate token distribution to presale participants and investor wallets;

- Provide investors with the ability to trade their locked tokens (ownership claim to those tokens) on kDEX.

Tokenomics Breakdown

| Allocation | Percentage | Amount | Vesting |

|---|---|---|---|

| Pre Sale | 0.57% | 5,714,286 | 0% unlock on TGE, monthly release for 12 month |

| Public Sale | 1.75% | 17.5M | 10% unlock on TGE, monthly release for 12 month |

| Development | 15% | 50M | Locked for 6 months, then monthly release for 36 months |

| Team | 10% | 100M | Locked for 12 months, then monthly release for 36 months |

| Reserve | 14.68% | 146.8M | Locked for 6 months, then monthly release for 18 months |

| Liquidity | 15% | 150M | 20% unlocked at TGE, then monthly release for 12 months |

| Community | 7% | 70M | 10% unlocked at TGE, then monthly release for 24 months |

| Advisors | 5% | 50M | Locked for 12 months, then monthly release for 36 months |

Token Information

Name: Kaizen Finance

Symbol: $KZEN

Contract Address: 0x4550003152F120

14558e5CE025707E4DD841100F

Hard Cap (USD): $9,800,000

Money to be raised: $7,800,000

Total Token Supply: 1,000,000,000

Tokens for Public Sale: 1.75%

Initial Circulating Supply: 1,750,000 KZEN

Initial Circulating Supply: 0.18%

Initial Market Cap (USD): $70,000

Current TVL: $120,000,000

Community Pre-Sale price: $0.035

IDO price: $0.04

Public Sale Token Price: $0.04

Lockups

Team: 48 months

VCs: up to 36 months

Pre-Sale: 0% unlock on TGE, monthly release for 12 month

Public: 10% unlock on TGE, monthly release for 12 month

More Info

Kaizen Finance IDO on LavaX

- IDO Opens December 1 at 12:00pm UTC, will be 48hrs

- LavaX whitelist: kaizen-lavax kaizen-lavax

- Purchase with: BUSD

- Lockup: 10% unlock over 12 months

- Max contribution per ticket: TBC

Blacklisted countries

Australia, Bahamas, Canada, Iran, Iraq, Hong Kong, Japan, People’s Republic of China, New Zealand, United Kingdom, or the United States of America (including all of its territories);